In M&A contexts, real value isn’t captured through strategy alone, it materialises when the technology is ready to support it. We’ve included additional resources to give you more insight into how we approach tech transformation projects that maximise investment value.

Driving Business Value in M&A with

Software Modernisation

Technology can have a significant impact on the risk profile and value creation plan of an M&A.

In mergers and acquisitions (M&A), the focus is often on what’s visible: growth metrics, promising synergies, competitive advantages. But the tech underpinning the business can be central to your value creation plan and a source of some of the most significant risks.

It won’t show up on a balance sheet or in a spreadsheet. But it’s there—either enabling scalability, seamless integration, and innovation, or holding them back. When systems are weighed down by technical debt, poorly structured, or reliant on siloed knowledge, risks surface in the most unexpected ways: hidden costs, operational friction, and missed growth opportunities.

At Codurance, we help investment funds and scale-ups look beyond the numbers and make informed decisions with a clear, realistic, and actionable technology perspective.

- Before the acquisition, we conduct Technical Due Diligence to validate the investment thesis and identify potential technical blockers.

- After the acquisition, we design modernisation plans aligned with the investment thesis and built for long-term sustainability.

- During the value creation phase, we work on improving the software to ensure they support solid growth, enable integrations, and pave the way for a successful exit.

Behind every successful technology decision lies a well-assessed foundation, a prioritised roadmap, and a modernisation strategy that puts software evolution at the core of business growth.

How Does Software Impact the Success of an Acquisition?

At the heart of many businesses, even those that don’t label themselves as “tech”, lies software. It powers collaboration, drives products, automates processes and enables scale. But when technology decisions, such as sticking with legacy systems or pursuing short-term, tactical fixes, are not aligned with the company’s business goals or customer needs, software can become a constraint.

Understanding the role of software in business strategy is especially critical during mergers and acquisitions. In this section, we’ll explore the core challenges that software modernisation can help solve. These include not only technical debt or long development cycles, but more importantly, the misalignment between tech strategy and business value. We’ll also look at how choosing the right modernisation approach can help overcome these barriers and unlock your organisation’s full potential.

The Role of Software in M&A

Software modernisation isn’t just a technical upgrade. It’s a strategic lever for growth and integration after an acquisition. It’s about transforming what already exists to meet today’s challenges and seize tomorrow’s opportunities. Rewriting, migrating, redesigning, yes — but above all, rethinking.

When executed properly, this kind of technological transformation unlocks agility, reduces operational costs, and speeds up value delivery. It turns technology from a liability into a sustainable competitive advantage. A well-defined modernisation strategy can be the difference between a company ready to scale and one that struggles under the weight of its own tech stack.

In an M&A deal, software is not always just a technical side note. This is especially true when the value of the target company depends on it. For tech-enabled businesses, or when software is a core product, platform or operational enabler, its condition can directly impact valuation, post-acquisition integration and how quickly real synergies can be realised. Is it built to scale? Can it integrate with your ecosystem? Are there hidden risks beneath the surface?

In many cases, software is more than a tool. It may be the product itself, the sales engine or the system connecting finance, operations and customer support. In such cases, evaluating it thoroughly is just as important as reviewing the financial statements.

After more than a decade supporting investment funds and tech-enabled businesses, we’ve seen firsthand how fragile or misaligned technology foundations can drive up costs, delay value capture or even derail post-deal plans. That’s why we stress this point: including a Technical Due Diligence is not optional when software is central to the investment thesis. It is a critical tool to uncover hidden risks, reduce uncertainty and make informed decisions before the deal is signed.

Ultimately, it’s not about having perfect technology; it’s about having the right technology — the kind that allows you to grow, scale and evolve with confidence.

In an acquisition, financial metrics are only part of the equation. Experienced buyers look beyond the balance sheet. They want to know whether the technology is not only stable and scalable today, but also architected for future growth. Can it support the company’s strategic roadmap? Will it enable the product to deliver increased value over time (for instance being AI-ready) especially by the time they’re ready for exit?

Why Does Software Influence Valuation?

While it may go unnoticed in early conversations, software quality reveals far more than lines of code—it reflects the true state of a business and its ability to grow. At the core, buyers are looking for this:

- Operational stability: systems that run smoothly, without critical dependencies or frequent disruptions.

- Integration capability: technology that can easily connect with the buyer’s existing ecosystem.

- Future scalability: an architecture that supports growth opportunities without requiring a full rebuild.

- Compliance and security: alignment with legal and industry standards that prevent fines and reputational risks.

When software falls short of expectations, the consequences can be significant—rising integration costs, extended timelines, and increased operational risk. But what truly threatens a deal isn’t bad code—it’s a misalignment between the technology strategy and the business vision. In reality, most software can be fixed; what’s harder to correct, and more likely to stall or derail a deal, is a tech roadmap that doesn’t support long-term value creation.

In today’s M&A landscape, software is no longer just behind-the-scenes infrastructure—it’s a clear signal of how strategically prepared a company is to scale, innovate, and create value in the future.

![[EN]_2_How Software Influences a Company’s Valuation](https://www.codurance.com/hs-fs/hubfs/1_Social%20Media%20-%20Spanish/2025/Pillar%20Pager%20Tech%20Due%20Diligence/%5BEN%5D_2_How%20Software%20Influences%20a%20Company%E2%80%99s%20Valuation.png?width=892&height=419&name=%5BEN%5D_2_How%20Software%20Influences%20a%20Company%E2%80%99s%20Valuation.png)

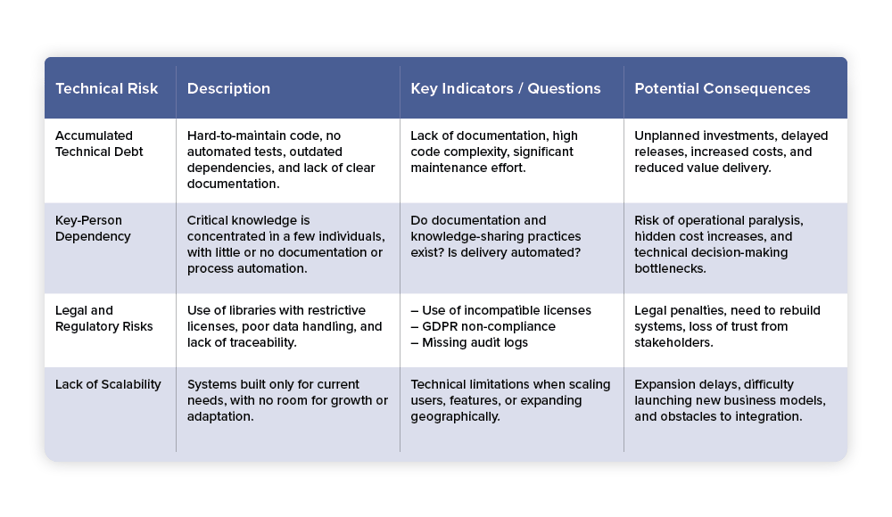

Technical Risks in M&A

They don’t always show up in the initial stages of an M&A deal. You won’t see them in financial statements or commercial KPIs. But they’re there—hidden in the codebase and past decisions: legacy software. And although it sometimes flies under the radar, it can become one of the most costly factors in the medium and long term.

Overlooking technical risks in mergers and acquisitions can lead to delays, cost overruns, and strategic roadblocks, right when progress is most critical. Identifying these risks early through a thorough technology audit is essential to protect the value of the deal and enable a smooth post-acquisition integration.

Here are some of the most common technical challenges in M&A processes:

-

Accumulated Technical Debt

This includes overly complex code, lacking automated tests, with outdated dependencies and no active maintenance. Often it’s undocumented and built on architectures that resist evolution.

When growth or integration begins, this technical debt becomes an unexpected drag. The need to stabilise or rewrite critical components can force unplanned investments, disrupt roadmaps, and divert focus. The impact isn’t just technical - it can delay delivery of business value from the acquired company.

-

Key-Person Dependency

Some systems are so custom-built that only one or two people on the tech team truly understand how they work. The knowledge is undocumented, not shared, and often not automated.

These questions help assess the risk:

- What level of documentation exists?

- Is knowledge distributed or centralised?

- Are delivery processes automated?

When the answers reveal centralisation and manual processes, it's a red flag. If those key individuals don’t stay post-acquisition, or if knowledge transfer fails, control can be lost over critical parts of the system. The result: operational standstill, technical bottlenecks, and growing costs due to lack of continuity.

-

Legal and Regulatory Risks

Not all legal issues are found in contracts. Some are embedded in the software itself:

- Use of libraries with restrictive or incompatible licenses.

- Mishandling of personal data.

- Lack of traceability or absence of logs for audits.

- Non-compliance with regulations like GDPR.

When these issues surface, the consequences can be severe - from regulatory fines to loss of customer or investor trust. In some cases, entire systems need to be rebuilt to align with legal requirements, redirecting time, budget, and strategic focus.

-

Lack of Scalability

Some systems were built to meet only current needs, with no thought for future growth. They work, for now. But when demand increases (in volume, features, or global reach), they collapse or require major redesigns.

This limits the ability to capture new opportunities. It hinders operational scaling, delays new business models, and makes it harder to integrate new teams or geographies. Instead of supporting expansion, the software becomes an obstacle.

It's not about eliminating every risk - it’s about identifying them early. When technical factors are assessed and understood from the start, it becomes possible to anticipate contingencies, prioritise effectively, and ensure a smooth transition. Because in any growth operation, the true potential of a business doesn’t lie only in its strategy, but in the strength of the technology behind it.

Why to Modernise During the Value Creation Phase

n any merger or acquisition, every decision has a direct impact on the value the deal can generate. One of the most critical and yet often overlooked decisions is modernising legacy software. This isn’t just a technical issue; it’s a strategic opportunity to align the technological infrastructure with the new business vision.

Modernisation means deciding which systems to keep, which to transform, and which to decommission from the digital ecosystem. The earlier these decisions are made (ideally during the due diligence phase), the greater the ability businesses have to integrate, generate synergies, and move forward without technological debt.

Below are the key reasons to address modernisation from the very beginning of the integration process:

1. Lower Costs and Faster Delivery through Software Modernisation

Modernising legacy applications is one of the most effective ways to unlock value in the post-acquisition phase. According to Deloitte, organisations that modernise their core software systems report up to a 50% reduction in costs and a 25% increase in delivery speed compared to traditional approaches.

By replacing outdated codebases, automating the extraction of business logic, and migrating to more flexible architectures, companies reduce technical debt, eliminate inefficiencies, and enable faster integration with new environments. These changes not only lower operational costs but also accelerate time-to-value - critical in high-pressure M&A contexts.

2. Faster Synergies and Results

Well-executed technology integration accelerates value capture. McKinsey estimates that companies with strong post-merger integration processes, particularly those that prioritise software and systems integration, achieve total return to shareholders (TRS) that is 6 to 12 percentage points higher than those with weaker integration.

This focus on early alignment is gaining ground: in 2022, 60% of acquiring companies were already defining the post-merger operating model during due diligence, compared to only 25% in 2019, according to PwC. For many, this includes assessing software capabilities and identifying areas where technology modernisation can support faster integration.

Furthermore, 41% of the most successful acquirers begin addressing technology considerations, such as system compatibility, architecture fit and scalability, as early as the target selection stage. As BCG highlights, software plays a key role in deal success: it not only accounts for over 10% of deal synergies, but also enables up to 85% of operational synergies. In contrast, delaying modernisation or relying on outdated systems during integration can leave an organisation 3 to 4 years behind more proactive competitors.

3. Boost in Productivity and Operational Efficiency

Beyond cost savings, modernisation has a direct impact on productivity. McKinsey reports up to a 20% improvement in efficiency and a 15% increase in team productivity when duplicate systems and tasks are eliminated, and previously fragmented operations are integrated into a more cohesive workflow.

Failing to address this can be costly: according to Vorecol, companies can lose up to $5 million a year due to inefficiencies such as duplicated tasks, reconciliation errors, or manual rework. Early modernisation is key to avoiding these bottlenecks and sustaining long-term growth.

Modernising legacy software during a merger helps reduce costs, accelerate results, and improve operational performance. Organisations that adopt a technology strategy from the early stages of M&A achieve higher-quality synergies, faster delivery, and stronger competitive positioning.

At Codurance, we approach M&A modernisation with a strategic and incremental mindset. We thoroughly assess the software landscape, prioritise high-value areas, and execute with a focus on stability and alignment with business goals. It’s not about rebuilding everything, it’s about modernising with intention.

Because in an acquisition, technology shouldn’t be a bottleneck—it should be a catalyst for growth. And the data supports this: a well-executed modernisation strategy can reduce integration costs by up to 30%.

|

KEY TAKEAWAYS: In an acquisition, software is not just a technical asset, it’s a real reflection of a company’s potential to scale, integrate and sustain growth. Its condition directly impacts valuation, integration costs and the speed at which synergies are captured. Legacy systems, technical debt, legal risks or dependence on key individuals can turn a promising opportunity into an expensive problem. Modernising at the right time - by evaluating what to keep, what to transform and what to eliminate, not only reduces hidden risks but also accelerates value creation. Because in M&A, a solid technology foundation isn’t a luxury. It’s a prerequisite for long-term success

|

How to Assess Technological Potential Before an Acquisition

Before closing an acquisition deal, there's one crucial question that must be answered: Is this company’s technology truly ready to support its projected growth? This is where Technical Due Diligence plays a critical role, providing a comprehensive view of the company’s tech capabilities.

Technical Due Diligence goes beyond checking whether the software “works.” Its real purpose is to evaluate whether the technology can scale, adapt, and remain relevant over time. A well-executed technical due diligence allows you to move past the surface and uncover the factors that are enabling or could hinder future value delivery post-acquisition.

Key areas include:

- Architecture and scalability - Can the tech foundation grow without becoming a bottleneck?

- Code quality and technical debt - How maintainable is the system, and what effort will it take to support it?

- Development and operational processes - Can the team deliver quickly and reliably without relying on “hero” developers?

- Team capabilities - Is knowledge shared or siloed, and does the business rely heavily on key individuals with no clear backup?

- Hidden risks - From security flaws and poorly managed licenses to fragile deployment practices.

Conducting a Technical Due Diligence helps identify barriers to growth, anticipate the real cost of integration, uncover invisible risks, and adjust expectations with clear, data-backed insights. Often, the findings from this analysis can shift the entire direction of the deal leading to renegotiations, changes in strategy, or even the decision to walk away.

What Is a Technical Due Diligence?

Technical Due Diligence is a strategic tool used to validate whether a company’s technology can support the future envisioned by the investment. Unlike legal or financial due diligence, it focuses on the technical side of the business, from systems and processes to the key people behind them.

In companies where the product is the business (such as SaaS platforms, marketplaces, or tech-enabled business service providers), this analysis can mean the difference between acquiring a promising idea and acquiring a solid technological foundation.

What does a Technical Due Diligence assess?

Technical Due Diligence is far more than a basic technical audit. It’s a deep dive into the company’s technology infrastructure, evaluating whether the digital engine powering the business can sustain its projected growth. It’s not just about whether the system works today but whether it can scale, evolve, and remain resilient over time.

Key components typically analysed include:

- Source code and technical quality - Maintainability, scalability, test coverage, technical debt, design patterns, and technologies used.

- Architecture and dependencies - Scalability, critical coupling, third-party integrations, and alignment with business goals.

- Development and operations processes - CI/CD practices, presence of staging environments, DevOps culture, monitoring capabilities, and deployment agility.

- Technical team capabilities - Knowledge distribution, reliance on key individuals, process maturity, and technical autonomy.

- Product maturity - Level of market validation, roadmap clarity, user experience, and adaptability.

- Regulatory compliance - Review of GDPR practices, license management, and applicable frameworks (ISO, PCI-DSS, etc.).

- Infrastructure and security - Cloud architecture, operational resilience, cybersecurity posture, and risk exposure.

- Intellectual property - Ownership and protection of technological assets and rights associated with the software.

Why does it directly impact the investment decision?

A well-executed Technical Due Diligence has the power to reshape how a deal is viewed. The insights it provides allow for a more accurate and objective understanding of the technology, enabling informed, realistic decisions. With this visibility, it becomes possible to:

- Renegotiate the price or adjust provisions based on the actual state of the software and infrastructure.

- Accurately estimate integration or modernisation costs, anticipating necessary investments from day one.

- Redirect the deal strategy toward a more viable and sustainable growth path.

- Clearly decide whether to move forward, pause, or rethink the transaction, avoiding commitments that are difficult (and costly) to reverse later on.

In some cases, the technical assessment confirms that the investment is solid and scalable. In others, it uncovers critical weaknesses that require a strategic shift or even walking away from the deal altogether. But in every case, the value remains the same: it brings certainty to a space where assumptions can be expensive.

How is a Technical Due Diligence structured?

For strategic decisions to be truly well-informed, it's not enough to surface good finding, it must follow a clear and consistent structure. While every company has its own unique challenges, the process is generally organised into the following stages to build a complete and actionable view of the business's technical landscape:

- Interviews with key stakeholders: CTOs, product leads, tech team leaders, and other relevant voices provide critical context and strategic perspective.

- Code and architecture review: A deep dive into the current state of the software, existing technical debt, automation levels, and adherence to best practices.

- Assessment of processes and tools: Examining operational efficiency, team agility, workflows, and the maturity of continuous delivery practices.

- Team and knowledge analysis: Evaluating team structure, key talent, technical documentation levels, and risks related to knowledge silos or dependency on specific individuals.

- Product analysis: Reviewing functional evolution, market validation, clarity of product vision, and potential bottlenecks that may limit scalability.

This process is approached holistically, from the initial technical assessment to post-acquisition execution with a focus on continuity, transformation, and long-term value creation. This may include tech modernisation, change management, team enablement, and strengthening technical and organisational processes.

Identifying risks is just the first step; what truly transforms an acquisition is knowing how to address them and turn them into growth opportunities.

![[EN]_4_Structure of a Technical Due Diligence (TDD)](https://www.codurance.com/hs-fs/hubfs/1_Social%20Media%20-%20Spanish/2025/Pillar%20Pager%20Tech%20Due%20Diligence/%5BEN%5D_4_Structure%20of%20a%20Technical%20Due%20Diligence%20(TDD).png?width=892&height=446&name=%5BEN%5D_4_Structure%20of%20a%20Technical%20Due%20Diligence%20(TDD).png)

Legacy Software and Acquisition Risk

Not all legacy software carries the same level or type of risk during an acquisition. Understanding the technical nature of legacy systems is essential to anticipate modernisation efforts and make informed decisions from the very first analysis. Classifying systems based on their complexity and strategic value allows for the creation of a realistic roadmap and helps align technical priorities with the deal’s objectives.

Within this context, we typically encounter several categories of software that present different risk levels and require tailored approaches:

Common Types of Software

- Simple software: Characterised by low code volume, minimal technology dependencies, and stable functionality. While modernisation tends to be more straightforward, it shouldn't be underestimated. This kind of software often hides accumulated technical debt or poor design decisions that can create future friction. Identifying these weak spots early helps avoid costly surprises down the road.

- IP-rich software: Involves applications that encapsulate critical business logic or key intellectual property. Here, the value lies not just in the code, but in the embedded knowledge. These solutions require a detailed evaluation of their architecture, maintainability, and ability to scale without compromising competitive advantage. The risks are both technical and organisational.

- AI-rich software: Integrates machine learning, automation, or artificial intelligence models where the risk goes beyond implementation to include governance. Reviewing data traceability, model versioning, and control mechanisms is vital to avoid regulatory or quality issues. A well-executed AI audit can prevent future compliance and performance challenges.

- Software providers: These are companies whose core product is commercial software delivered to third parties. In this case, code robustness, modularity, deployment strategy, and technical support quality directly impact customer experience, reputation, and overall business viability. Evaluating the quality of the software and its supporting infrastructure is key to ensuring a consistent, reliable user experience post-acquisition.

![[EN]_1_4 Common Software Types](https://www.codurance.com/hs-fs/hubfs/1_Social%20Media%20-%20Spanish/2025/Pillar%20Pager%20Tech%20Due%20Diligence/%5BEN%5D_1_4%20Common%20Software%20Types.png?width=892&height=446&name=%5BEN%5D_1_4%20Common%20Software%20Types.png)

How to Manage Legacy Software Risk in Acquisitions

The above classification allows for prioritising efforts, anticipating bottlenecks, and allocating resources more efficiently. While a simple solution can be modernised quickly and deliver immediate value, an IP-rich product will require a progressive transformation focused on preserving the knowledge that makes it valuable.

Aligning this approach with the strategic intent of the deal, whether it’s to scale, integrate, or reinvent, optimises technical investment and reduces the risk of post-acquisition disruptions. At Codurance, we guide this process from start to finish, ensuring that every technical decision serves the business and its sustainable growth.

Modernise or Replace?

Deciding whether to modernise or replace a legacy system is a strategic decision that requires thorough analysis. It's not just about the cost of transforming the system, but also about how much value it can continue to generate for the business and the impact of keeping it unchanged. To make this decision with sound judgment, several factors should be considered from the outset:

System's Differentiating Value:

If the software encapsulates critical business logic or a competitive advantage that is difficult to replicate, modernising is usually a more cost-effective option than replacing it. Modernisation usually allows you to preserve the system's unique value and leverage existing assets.

Technical Condition:

It’s essential to assess how outdated the current technology is and whether it allows for scalability, easy integration with new environments, or adaptation to market changes such as the ability to adopt emerging AI solutions. An outdated system could limit flexibility and the ability to respond to new challenges, justifying its replacement.

Opportunity Cost:

Maintaining a legacy system can come with hidden costs, such as stifling innovation or losing efficiency. This opportunity cost may be even higher if the system limits the ability to adapt to new market or customer needs.

External Dependencies:

Third-party integrations, sector-specific regulations, or ties to particular vendors can limit flexibility and impact both the modernisation and replacement of the system. These external dependencies should be carefully assessed before making a decision.

Evaluating Cost-Benefit

Beyond the technical analysis, it’s crucial to conduct a realistic cost-benefit evaluation. This includes considering not only the development effort but also:

- Current maintenance and support costs.

- The time and resources required to adapt the system to new needs.

- Technical and business risks associated with the change, such as disruptions, knowledge loss, or steep learning curves.

- Potential benefits such as faster delivery, scalability, automation, error reduction, and operational efficiency.

Alignment with Post-Acquisition Goals

All of this should be measured in light of the strategic objectives the acquisition aims to achieve. Modernising or replacing a system is not the end goal but a means to achieve something greater. These objectives may include:

- Rapid scaling.

- Efficient integration of operations.

- Structural cost reduction.

- Development of new digital services.

Technical and Strategic Criteria

It’s vital to work closely with both technical and business teams to ensure that each decision aligns with the long-term vision. The goal is to build systems that are sustainable, flexible, and capable of supporting continuous growth. In technology, what matters is not just what you change, but why you change it.

How Modernisation Drives Real Value After an Acquisition

Imagine a newly acquired company: strategic ambition, new goals, and a latent pressure to deliver immediate results. In this scenario, technology can either become a springboard for growth or a trap that limits progress. When approached with a strategic vision, technological modernisation transforms into a true value driver, capable of accelerating integration, unlocking growth potential, and eliminating barriers to innovation. But how is this achieved in practice?

Enabling Growth and Expansion

A modern infrastructure not only supports the business but propels it forward. It enables frictionless scaling, faster product launches, and the agility to adapt to new strategic directions. In post-acquisition contexts, where expansion plans are often ambitious, having systems that can keep up with that pace is key to meeting objectives without delays.

Easier Integration

In every acquisition, there’s an inevitable clash of systems. Modernisation softens this impact by allowing for the exposure of services, decoupling of components, and adoption of common technological standards. The result? Better communication between teams, smoother technology integration, and operations moving forward without redundancies or bottlenecks.

Time-to-Market and Team Autonomy

In increasingly dynamic markets, speed is a competitive advantage. Adopting modern architectures (such as micro-services, well-defined APIs, or CI/CD pipelines) enables teams to operate more independently, reducing the gap between an idea and its launch. This translates into a more agile response to business needs.

Reducing Technical Debt as a Competitive Advantage

Technical debt is not just a legacy of the past; it’s a real roadblock to the future. Modernisation helps clear the path: it improves software quality, simplifies maintenance, reduces operational costs, and frees teams to focus on what truly generates value. The result is greater sustained innovation capacity.

Strategy from Day One

In an acquisition process, every minute counts. Acting from the very first analysis with a well-defined modernisation strategy can make the difference between a transformative impact and a process full of obstacles. Designing a roadmap aligned with business objectives is crucial to ensuring tangible results from the start, minimising risks, and maximising the return on technological investment.

Modernisation Roadmaps: How to Go from Vision to Action

Modernisation is not a ‘big bang’. Every transformation begins with an intention. But turning that intention into reality requires more than inspiring ideas: it needs clear direction, defined priorities, and a solid modernisation roadmap. In an acquisition process, where time is critical and legacy systems are a bottleneck, a well-designed roadmap is the bridge between business potential and the delivery of tangible value.

Breaking the Process into Realistic Phases

Effective modernisation is not a sudden change but a well-structured process. It’s not about rewriting everything at once or applying makeshift solutions. True progress comes from knowing where to start and what to prioritise.

Post-acquisition value creation typically begins with a set of tactical actions designed to deliver quick wins and build trust in the transformation process. This often includes decoupling critical modules, improving observability, updating outdated libraries, or removing technical bottlenecks.

As the transformation advances, the focus shifts to core systems: refactoring workflows, aligning teams, and optimising the architecture to support scalability and resilience. This is where the foundation for long-term value is established.

Eventually, the emphasis moves towards strategic evolution - replatforming, rewriting key services, or selectively replacing legacy components to enable future growth. While the timing of each phase may vary depending on the context, aligning efforts with the company’s strategic goals and the investor’s value creation timeline, often structured as a 100-day plan, is essential to unlocking full potential.

Using Metrics to Measure Continuous Improvement

A modernisation without metrics is like navigating without a compass. For each phase to deliver real value, it’s key to measure, adjust, and evolve based on data. Here are some essential metrics:

- Lead time: Measures how fast an idea becomes available functionality.

- Deployment frequency: Indicates how often we deliver value to the business.

- Change failure rate: Assesses how many changes generate avoidable errors.

- Mean time to recovery: Shows how agile the response is when failures occur.

These metrics are not bureaucracy. They are signals that help minimise risks, detect deviations, and maximise the impact of each action.

![[EN]_5_Modernisation Roadmaps](https://www.codurance.com/hs-fs/hubfs/1_Social%20Media%20-%20Spanish/2025/Pillar%20Pager%20Tech%20Due%20Diligence/%5BEN%5D_5_Modernisation%20Roadmaps.png?width=892&height=268&name=%5BEN%5D_5_Modernisation%20Roadmaps.png)

Minimising Risks During Transition

Modernisation is not about breaking things; it’s about transforming with security. The most successful organisations apply practices that reduce uncertainty and protect the user experience:

- Feature toggles: Activate new features only when they are ready.

- Canary releases: Deploy changes in small batches before rolling them out broadly.

- Automated testing and parallel environments: Prevent unwanted regressions.

- Observability from the start: Allows you to see, understand, and act in real time.

From our experience, we know that modernisation is not just a technical challenge; it’s a lever to accelerate value creation post-acquisition. That’s why we not only design the roadmap but execute it alongside our clients, ensuring every step aligns with strategic goals. With modern practices in architecture, engineering, and agility, we turn an ambitious vision into tangible reality.

|

KEY TAKEAWAYS: Before closing an acquisition, it’s crucial to understand whether the company’s technology can scale, integrate, and sustain the growth it promises. Technical Due Diligence helps anticipate hidden risks, evaluate the technical maturity of the product, identify operational bottlenecks, and estimate the actual effort required for integration or modernisation. More than just an audit, it is a strategic tool that turns uncertainty into evidence, enabling investment decisions to be made with a clear, realistic vision aligned with the business’s future value. |

Post-Acquisition: How to Move from Technical Analysis to Concrete Results

A well-executed Technical Due Diligence evaluates the state of systems, uncovering what drives or hinders business growth. But the analysis is just the beginning. The real differentiator comes after: when it's time to act, prioritise, and turn technical findings into strategic decisions with measurable returns.

At Codurance, we help make that transition effective. We work with our clients to transform a technical report into a clear, prioritised roadmap focused on results. The goal is not only to modernise systems but to generate visible value from the first quarter post-deal.

Initial Steps After a Technical Due Diligence

-

Post-Acquisition Prioritisation: Focus on What Drives the Business

Not all problems or opportunities are of equal importance. We help classify each initiative based on:- Impact on business KPIs: time-to-market, efficiency, scalability, compliance

- Urgency: technical risks, blockers to integration or growth

- Effort: technical complexity, resources needed, dependencies

- Expected return: savings, agility, new business lines

-

Quick Wins with High Impact: Fast Results that Generate Traction

After an acquisition, delivering quick results is key to building trust. We design short-term tactical actions that:- Eliminate immediate bottlenecks (e.g., slow deployments or poorly designed critical modules)

- Boost team morale and stakeholder confidence

- Validate technical and strategic hypotheses

-

Engaging key stakeholders early in the process

An effective technological transformation isn't just the responsibility of the technical team. That's why we work from the start with business, investment, and operations profiles to:

-

- Align objectives and priorities

- Translate technical issues into risks and opportunities that everyone can understand

- Ensure sponsorship and budget

- Establish governance and tracking mechanisms

We don’t impose a roadmap; we build it together. This way, each stakeholder understands how technical decisions impact the success of the deal. -

-

Actionable Roadmap with Value Hypotheses and Clear Metrics

Every technical action is based on a value hypothesis. It's not about refactoring "just because"; it’s about achieving measurable improvements:- Refactoring → fewer errors → better customer experience (NPS)

- Automated deployments → shorter lead time → higher delivery frequency

- Modular redesign → more autonomy → greater organisational scalability

We measure that impact with metrics like:

- Deployment Frequency

- Lead Time for Changes

- Change Failure Rate

- Mean Time to Recovery

- Costs Avoided from Errors or Frictions

This turns every technical investment into a strategic argument for the executive committee or fund.

- Scalability and Sustainability from Day One

Modernising systems after an acquisition isn't about applying patches. It's about preparing the business to grow steadily. That's why we balance quick wins with structural changes that:

- Eliminate accumulated technical debt

- Reduce dependence on key individuals

- Strengthen architecture for scaling future products or integrations

|

KEY TAKEAWAYS: Turning technical findings into real value is not just about modernising the technology; it’s about choosing the right approach. It requires judgment to prioritise, clarity to execute, a common language to align, and metrics to demonstrate impact. |

Choosing a Partner for a Technical Due Diligence

At Codurance, we don’t leave our clients with just a diagnosis; we support them in designing and executing a technological transformation that enables growth, from the first quarter post-acquisition to the long term. Because an acquisition doesn’t guarantee success on its own: for it to truly create value (i.e. growth, efficiency, seamless integration, innovation), the technology of the acquired company must be ready to sustain that change.

In other words: You may have a great business strategy, but if the software doesn’t scale, isn’t secure, relies on key individuals, or fails to integrate smoothly, that potential value is lost.

At Codurance, we approach software modernisation as a holistic strategy, combining technical excellence with organisational evolution. We are a specialised software consultancy with expert teams in Software Craftsmanship, agility, and scalability. We help companies to:

- Scale with sustainable systems

- Accelerate innovation without sacrificing reliability

- Integrate quickly after mergers or acquisitions

- Reduce technical debt and dependency risks

With every project, our goal is clear: to turn software into a true growth engine—not a bottleneck. That’s why we are the trusted partner for Private Equity funds and Venture Capital-backed scaleups, accelerating their growth through mergers and acquisitions (M&As) across all stages of the investment cycle.

With a solid track record in sectors such as retail, healthcare, banking, and logistics, we deliver tangible results thanks to:![[EN] PDF CTA flyer technical due diligence](https://www.codurance.com/hs-fs/hubfs/1_Social%20Media%20-%20Spanish/2025/Pillar%20Pager%20Tech%20Due%20Diligence/%5BEN%5D%20PDF%20CTA%20flyer%20technical%20due%20diligence.png?width=250&height=300&name=%5BEN%5D%20PDF%20CTA%20flyer%20technical%20due%20diligence.png)

- Proprietary frameworks that maximise speed without compromising quality

- Highly specialised, globally distributed teams

- The ability to integrate from day one and generate early impact

10 Lessons Learned About Software Modernisation

With over a decade of experience, we have gained valuable insights into how we approach and structure our projects.

- The business sets the course: Every modernisation initiative should be guided by strategic objectives. The technology architecture must enable the capabilities the business needs to scale, not just address specific technical needs.

- Not everything requires the same approach: It’s not necessary to rewrite everything from scratch. A hybrid approach (combining refactoring, migration, or maintenance) allows for resource optimisation and risk minimisation.

- Explain the "why", not just the "how": Software modernisation involves change management. Communicating the value for the business and the risks of not acting helps align expectations and gain commitment from all stakeholders.

- Assess the team’s capabilities: Before starting, it’s crucial to identify whether the team has the necessary skills. Where there are gaps, it’s advisable to train or bring in external support to accelerate the process without compromising quality.

- Modernisation also means transforming the way we work: Changing only the code isn’t enough. True technological transformation requires fostering a culture of continuous improvement, collaboration, and learning.

- Technical excellence is non-negotiable: We apply the principles of Software Craftsmanship: professionalism, pragmatism, and a constant pursuit of quality. This foundation is key to building evolving, secure, and sustainable systems.

- Listen to the customer, always: The best solutions come from a deep understanding of the business and its real needs. Empathy and close collaboration are essential to designing software that truly adds value.

- Flexibility is key: There are no one-size-fits-all solutions. Adapting to changes in the environment and adjusting decisions on the fly is what turns a good project into a great result.

- Starting well means starting with focus: Defining a clear starting point avoids waste, allows for quick wins, and builds trust in the modernisation process.

- Modernisation is not just technical; it’s organisational: Technological transformation also involves reviewing processes, updating structures, and preparing the team for new ways of working.

Bibliography

- McKinsey & Company. (2024, March 11). From legacy to cloud: Lessons from the trenches. Retrieved from: https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/from-legacy-to-cloud-lessons-from-the-trenches

- Deloitte. (2023, October 24). Accelerating IT synergies capture. Retrieved from: https://www.deloitte.com/ch/en/services/financial-advisory/research/accelerating-it-services.html

- McKinsey. (n.d.). How the best acquirers excel at integration. Retrieved from: https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/how-the-best-acquirers-excel-at-integration

- PwC. (2023). 2023 M&A Integration Survey. Retrieved from: https://www.pwc.com/us/en/services/consulting/deals/library/ma-integration-survey.html

-

Boston Consulting Group. (2024, March 19). Technology’s Central Role in Post-Merger Integration. Retrieved from: https://www.bcg.com/publications/2024/technologys-role-in-the-post-merger-process#:~:text=approximately%2010,%28See%20Exhibit%202

-

Accenture. (2022). Mapping the DNA of M&A Value: Technology's Role. Retrieved from: https://www.accenture.com/content/dam/accenture/final/a-com-migration/pdf/pdf-176/accenture-mapping-dna-ma-value-technology-pov.pdf

-

Vorecol. (n.d.). Challenges and Solutions in Integrating Legacy Systems. Retrieved from: https://vorecol.com/blogs/blog-challenges-and-solutions-in-integrating-legacy-systems-during-mergers-169988

Need clarity before taking the next step in your project or acquisition?

Let’s talk. We’ll help you uncover hidden risks and real opportunities with our Technical Due Diligence approach.